Reading candlestick charts is an effective way to study the emotions of other traders and to interpret price. As a swing trader I have to get in before the crowd piles in, not when they get in! In other words, I want to be one of the traders that make up the pattern itself! That is the low risk, high odds play. If a stock pulls back to an area of demand (support) and I have a candlestick pattern that is telling me that buyers are taking control of the stock, then that is all the confirmation I need. This is absolutely ridiculous! I ain'twaitin' for nostinkin' confirmation! How's that for good grammar! Seriously, think about it for a second. This means that they are supposed to wait until the following day to see if the stock reverses afterward. Most traders are taught to "wait for confirmation" with candlestick patterns. This "shock event" forces short sellers to cover and brings in new traders on the long side. Then, on the next day, the stock gaps open above the previous days high and close. In the bullish version, the stock is moving down and the last red candle closes at the bottom of the range.

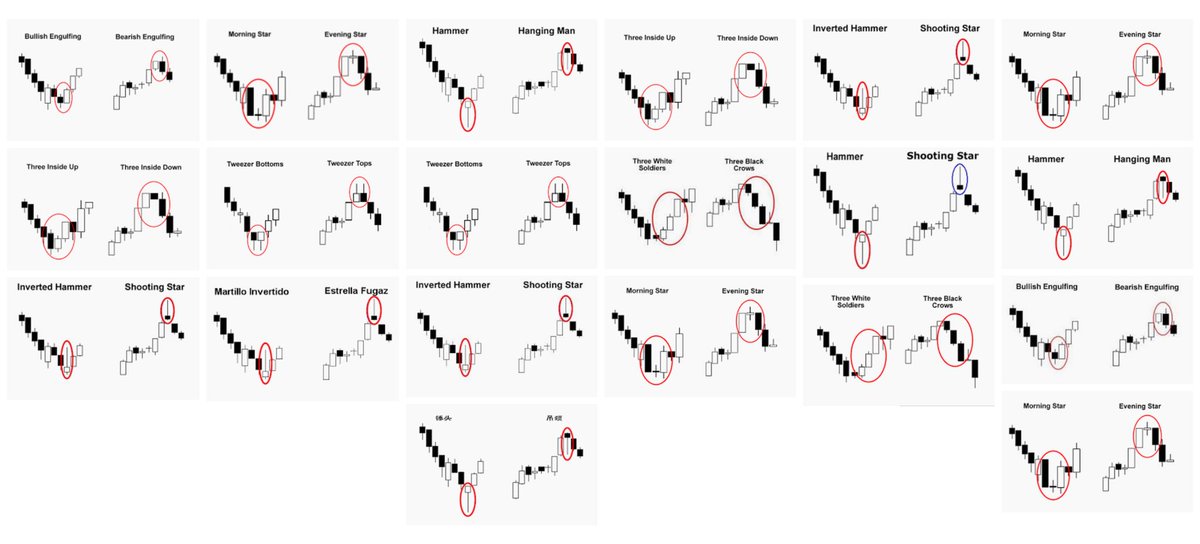

Like most candle patterns there is a bullish and bearish version. You can see in the above graphic why this pattern is so explosive. A "kicker" is sometimes referred to as the most powerful candlestick pattern of all. There is one more pattern worthy of mention. Look at each candle and try to get into the minds of the traders involved in the candle. Ok, now it's your turn! I'll let you figure out what is happening in each of the patterns above to cause these to be considered bearish. These patterns come after a rally and signify a possible reversal just like the bullish patterns. You'll notice that all of these bearish patterns are the opposite of the bullish patterns.

This can often trigger reversals in the opposite direction. Indecision and causes traders to question the current trend. The stock opens up and goes nowhere throughout the day and closes right at or near the opening price. Doji: The doji is probably the most popular candlestick pattern. Those that shorted the stock on first day are now sitting at a loss on the rally that happens on the second day. On the second day you see a wide range candle that has to close at least halfway into the prior candle. The candles are opposite! Piercing: This is also a two-candle reversal pattern where on the first day you see a wide range candle that closes near the bottom of the range. Note: Do not confuse this pattern with the engulfing pattern. Then on the second day, there is only a narrow range candle that closes up for the day. The sellers are still in control of this stock. On the first day you see a wide range candle that closes near the bottom of the range. Harami: When you see this pattern the first thing that comes to mind is that the momentum preceding it has stopped.

#BEST CANDLESTICK PATTERNS PDF PROFESSIONAL#

That's when professional traders come in to grab shares at a lower price. Hammers can develop after a cluster of stop loss orders are hit. By the end of the day, the buyers won and had enough strength to close the stock at the top of the range. Buyers are ready to take control of this stock! Hammer: As discussed on the previous page, the stock opened, then at some point the sellers took control of the stock and pushed it lower. The buyers have overwhelmed the sellers (demand is greater than supply). The second day is a wide range candle that "engulfs" the body of the first candle and closes near the top of the range. The sellers are still in control of the stock but because it is a narrow range candle and volatility is low, the sellers are not very aggressive.

The first day is a narrow range candle that closes down for the day. These are reversal patterns that show up after a pullback (bullish patterns) or a rally (bearish patterns).Įngulfing:This is my all timefavorite candlestick pattern. The following patterns are divided into two parts: Bullish patterns and bearish patterns. Does the hourly chart agree with your expectations on the daily chart? If so, then the odds of a reversal increase. For example, when you see one of these patterns on the daily chart, move down to the hourly chart. They must be combined with other forms of technical analysis to really be useful. Remember that these patterns are only useful when you understand what is happening in each pattern. Here are 10 candlestick patterns worth looking for. There are many candlestick patterns but only a few are actually worth knowing.

0 kommentar(er)

0 kommentar(er)